Say the words financial planning, and you’re likely to hear groans of derision and disdain. Most people associate financial planning with scrimping, saving, and making sacrifices. It’s not surprising then that people avoid thinking about financial planning like the flu. This is unfortunate because financial planning can be a very empowering tool both for families and individuals. When executed carefully and properly, Danny Ulanday of Pioneer Insurance says financial planning can help you and your family achieve life goals and live your desired lifestyle.

Planning for a brighter financial future involves five steps.

Step#1: Assess your current financial situation. Look at your cash flow, taking into account your income and expenses. Make an assessment of your assets and liabilities. Are you getting positive or negative figures? Based on these two documents, you can get a good picture of your financial standing. Take it one step further and do a risk analysis. If you lose your income, how long can your assets sustain you and your family? When analyzing your financial fitness, Ulanday says, “Be honest with yourself. If something happens to you, what will happen to your family? This is a wake up call.”

Step#2: Determine your financial goals. Having a clear idea of your financial standing will allow you to develop your goals for the short and long term, says Ulanday. If you find your assets woefully scant, then it’s time to start building them up. Start with a savings account, and move on to time deposits and other financial instruments. Set realistic goals which you can achieve in specific time periods.

Step#3: Create and determine a financial action plan. It’s time to do the nitty-gritty. Look at your assets and liabilities. If your assets are greater than your liabilities, then you may want to take the following steps:

* High liquid assets? Start investing. * High investment assets? Keep going. * High home assets? Start building your savings then invest. * High personal assets? Liquidate and invest in securities, rental property, or small business

If your liabilities are bigger than your assets, then take action to increase your assets and decrease your short-term and long-term liabilities. It would also be wise to manage your financial risks by building an emergency fund, purchasing life or health insurance policies, and acquiring property insurance, he says.

Step#4: Evaluate and revise action plan. After you’ve written your plan, go back to it and do a concrete review. Is it doable? Is it realistic? You can make as good a plan as you want, but if it’s too difficult to achieve then you’re just setting yourself up for failure. Don’t!

Step#5: Identify alternative courses of action. When looking at investment options, keep in mind that high risk instruments usually offer high rewards, and low risk ones, low rewards. You may invest in real estate, stocks, bonds, mutual funds, and unit investment trust funds. Your investment will not only depend on the amount of money you’re willing to invest but also on your risk tolerance. Conservative investors tend to go for low risk instruments while aggressive ones are happy to invest in high risk ones.

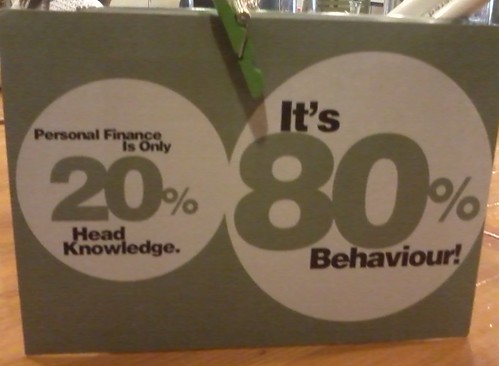

In the end, a plan is organic. It’s not set in stone so you can tweak it and change it according to your goals and desires. However, in order for your plan to work, Ulanday says you must commit to it 100 percent in order to achieve your financial goals.

Here’s a video to help you make better financial decisions: https://www.youtube.com/embed/5IVHn_pTIRQ

Here are some quotes you might want to keep in mind:

Leave a Reply